Why rebalance? A simple statistical story (part I)

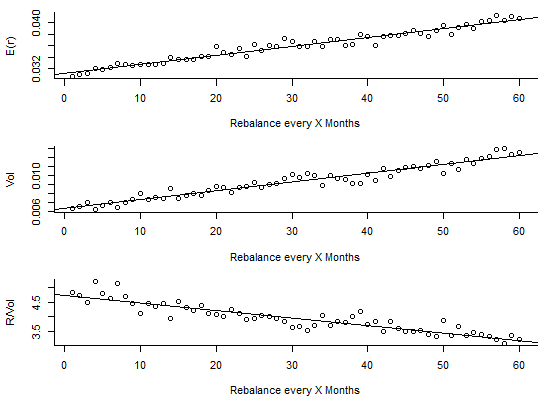

Once we have picked an asset allocation model, how often, or why should we rebalance? I’ve seen multiple conflicting findings about the usefulness of rebalancing. Many such conflicts happen in time-series data because the sample you use can influence things quite strongly. I therefore wanted to see if there was a simple, purely statistical basis for rebalancing. To do this, I simulated some pretty vanilla portfolios with the desired characteristics. Note that as this isn’t real data, it doesn’t have some of the finer characteristics of true returns data such as auto-correlation of volatility.