Research and Publications

Reviewed articles

Increasing tax salience reduces market timing

Many investors make mistakes when it comes to taxes - they actively trade in taxable accounts compared to tax-advantaged accounts, and realize short-term capital gains when long-term treatment would be preferable.

In a field experiment we show the effect of highlighting tax consequences of portfolio allocation changes before investors commit to the change. Allocation changes drop significantly when investors are notified of potential taxes owed.

Investor Satisfaction with Performance

What makes investor's happy with their performance, and how well do they optimize their own expected happiness?

Key factors include how much risk they took, their objectives, investment horizon, confidence, and other personal factors.

People are pretty accurate in their forecasts, and rarely are investors unhappy with outcomes they predicted they would be happy with.

However, experienced happiness is only partially predicted by the factors people believe will be important. In particular, relative performance plays an important role investors do not anticipate. Having outperformed other people contributes to investor happiness, as does active trading success.

The Meerkat effect: Personality and market returns affect investors’ portfolio monitoring behaviour

Do investors change how they monitor their investments depending on what the market has done recently?

Using data from a online brokerage we find that investors increase their portfolio monitoring following both positive and daily negative market returns, behaving more like hyper-vigilant meerkats than head-in-the-sand ostriches. This pattern persists for logins not resulting in trades and weekend logins when markets are closed. Moreover, a personality trait – neuroticism – moderates portfolio monitoring.

The Beliefs of Others – Naive Realism and Investing

Do people take other peoples expectations into account when investing? Yes.

What investors believe other people believe future stock market returns will be influences their own investment decisions. These second-order beliefs have an effect on investment decisions beyond influencing a persons own risk and return expectations…

… but they are inaccurate and exhibit several well-known psychological biases. First and second-order beliefs differ greatly despite the fact that investors have only a vague idea what other participants are thinking.

Among the biases we observe is investors’ belief that their own opinion is relatively more common among the population and that other investors who hold divergent expectations are biased.

When harm helps: building choice architecture for investors

Not infrequently, clients engage in behaviors—or request the option to engage in behaviors—that are on balance likely to be harmful. So why would any behavioral designer allow customers to make these choices?

Book chapters

Comparisons of Risk Attitudes across Individuals

… with Peter Brooks and Greg B. Davies, in The Encyclopedia of Operational Research and Management Science, Wiley, 2010.

Behavioral Investment Management

A book on modern portfolio optimization and management. Chapter 2, written with Peter Brooks discusses upgrades to risk-return frameworks and additional dimensions advisors can optimize along.

Barclays Wealth

New Year Resolutions

On average it takes around 65 days for a new virtuous habit to become automatic1. Based on this, it’s not surprising that new year resolutions are often forgotten by February. When it comes to your portfolio performance, virtuous habits and self-control strategies can make a massive difference, so it’s worth putting in the effort. To help you move towards better investing behaviour in 2012, we’ve come up with a few recommended resolutions.

Performance Assessment

How do we experience “good” performance? How can we know if we are in the right or wrong portfolio? Unfortunately, we’re not naturally equipped to answer this question easily. What our minds naturally look for to measure performance, and what they actually should be looking for, are two different things.

Behavioral Biases in the Market

By studying psychological biases we all have in common, behavioral finance has identified a number of “irrational” market anomalies which may contribute to persistent patterns in stock prices. But beware using these insights to try to beat the market …

Optimists

When we refer to a person as being “bullish” or “bearish” on an investment, we generally mean they believe it will rise or fall. This usually implies the person has researched the prospects of the investment, and come to some sort of conclusion. However, it may also be that some people are consistently more “bullish” or “bearish” than others, regardless of the asset in question or the market cycle.

Investor Management

Months like August test more than our ability to manage our investments — they test our ability to manage ourselves. With an understanding of specific behavioral vulnerabilities, we can preemptively enable ourselves to sail smoothly through the tempest.

Self-Directed Brokerage Panel

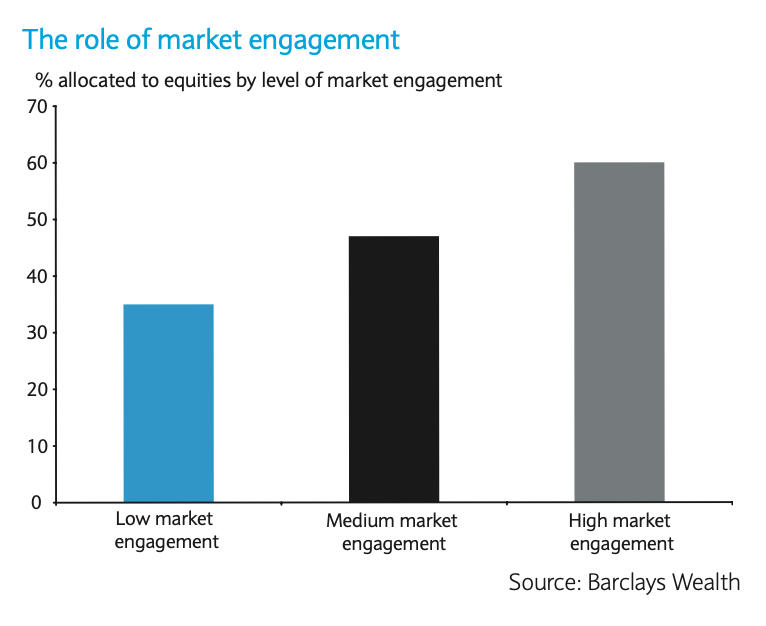

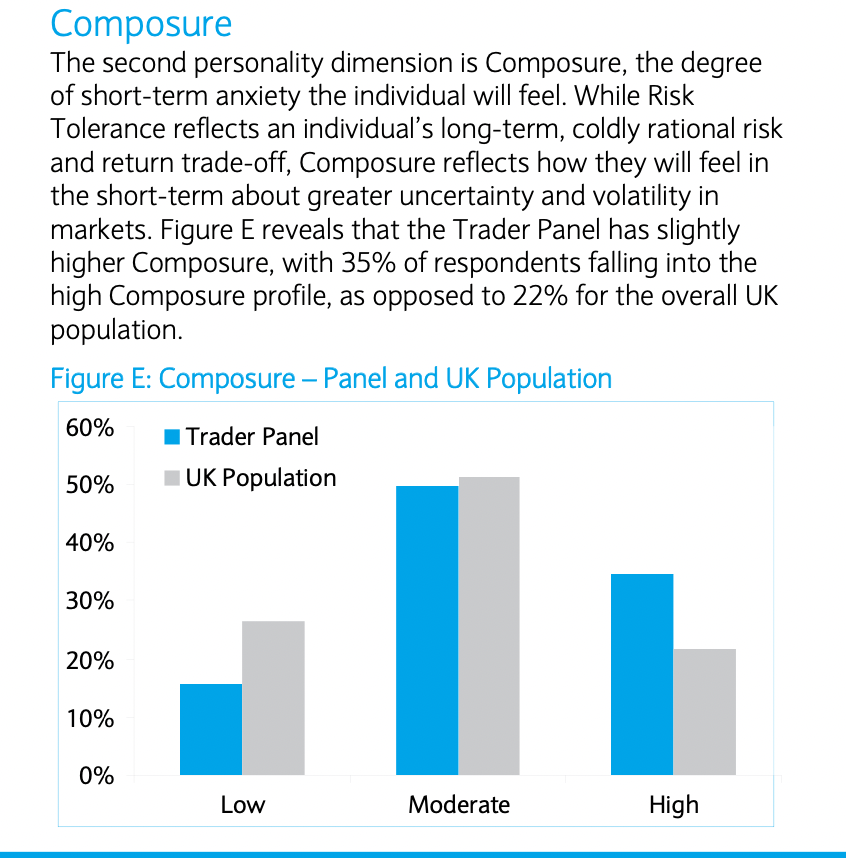

From 2008 - 2009 we conducted a quarterly panel survey of self-directed brokerage clients, asking them their views and beliefs about markets. We then dovetailed this self-reported subjective data with what they actually did in their accounts.

Individual participant profile

Every investor who participated in the panel received a personal profile based on their responses. Here’s an example.

Panel Overview

How do self-directed investors differ from the population at large? Using both demographics and psychographics we can see the fault lines along which people choose to self-manage their investments.

Know thyself

In one of the first publications to come from the panel: we link investor personality traits to actual investing behavior.