Underestimating compound growth, implications for savings rates

April 17, 2011

The Economist on using “nudges” and other behavioral economics tricks for improving pension and retirement savings:

ALBERT EINSTEIN IS said to have described compound interest as the eighth wonder of the world. It should also be a boon for workers planning their retirement. Start saving early enough and a pension becomes much more affordable. Unfortunately young people are often unable or unwilling to take advantage of this miracle. Their wages are low and their main priority may be to pay off their student debts or to save for a deposit on a house. Moreover, they may find it difficult to defer gratification or, as economists like to put it, they use hyperbolic discounting. Most of them would much rather have money in their hands today than put it aside for a retirement which they can barely imagine.

Yet note work by Michael Liersch and Craig McKenzie on how poorly we estimate compound savings growth:

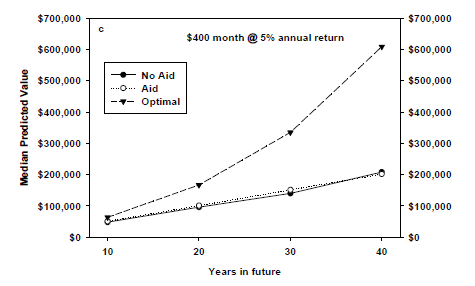

People systematically underestimate exponential growth. The current studies illustrate this phenomenon, its implications, and potential interventions, in the context of saving for retirement, where savings grow exponentially over long periods of time. Experiments 1 and 2 showed that the majority of participants expected savings over 40 years to grow linearly rather than exponentially. Experiment 3 demonstrated that this misunderstanding of savings growth led participants to massively underestimate the cost of waiting to save, which makes putting off saving more attractive than it ought to be. Finally, Experiments 4 and 5 showed that highlighting the exponential growth of savings motivated both college students and real employees to save more for retirement.