The perverse role of debt in feeling wealthy

March 3, 2012

I had the pleasure of meeting up with Abby Sussman of Princeton last night, who investigates the psychology of wealth - assets and liabilities. Her recent piece in Psychological Science sums it up well:

We studied the perception of wealth as a function of varying levels of assets and debt. We found that with total gross wealth held constant, people with positive net worth feel and are seen as wealthier when they have lower debt (despite having fewer assets). In contrast, people with equal but negative net worth feel and are considered wealthier when they have greater assets (despite having larger debt). This pattern persists in the perception of both the self and others. We explore consequences for the willingness to borrow and lend and briefly discuss the policy implications of these finding.

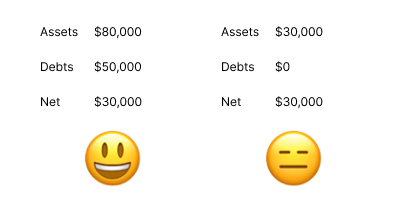

Here is a presentation laying it out. Get this:

Comparing two people in the black, 93% would rather have low debt and low assets. For people in red, 66% would rather have high debt and high assets. In playing the role of a loan officer, comparing the two profiles in the black, 75% would grant a loan to the person with low debt and low assets. For profiles in the red, 74% would grant the loan to the person with high debt and high assets.

So if we have positive net wealth, we are motivated to pay-down our debt, to feel and be considered wealthier. If we have negative net wealth (underwater home owners, ahem), we are motivated to take on more debt. And as outsiders, we apparently agree.