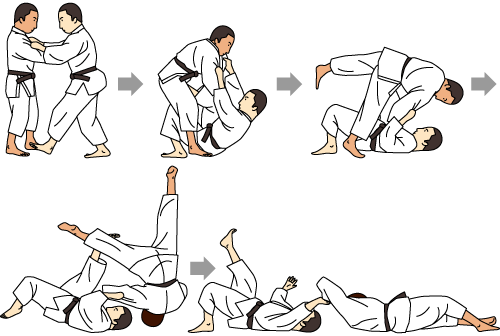

Sacrifice throws

February 23, 2020

Sutemi-waza are a class of throws in jujitsu or aikido known as sacrifice throws. They are tricky, but very powerful: they work because of the opponent’s momentum.

You don’t try to stop your opponent. You do not try to dodge them.

You accept and use the momentum, but redirect it.

Sutemi-waza are risky:

Sacrifice throws require the thrower to move into a potentially disadvantageous position in order to be executed, such as falling to the ground. The momentum of the falling body adds power to the throw and requires comparatively little strength, compared to the effect.

Emotional momentum

Behavioral sacrifice throws take a person’s emotional momentum and diverts it in a new, more productive direction.

You don’t try to deny their emotions, agitation and momentum; you shift the frame of reference so that the action they take is more likely to be beneficial.

An example: markets fell yesterday, and investor Kramer watched too much financial cable news. Kramer is in fight or flight mode, and wants to do something. He comes to you saying, “markets aren’t looking good. I think we need to sell.”

Yes, you can try appealing to Kramer’s rational side: do nothing, stay the course, focus on the long term, keep calm and carry on.

Or you can roll with their momentum and suggest actions like:

Should we tax-loss harvest and use the proceeds to buy what’s down the most (rebalance)?

Markets have fallen - is this the cash-on-the-sidelines buying opportunity you’ve been waiting for?

Is this a good time to get out of those high-cost funds that we weren’t selling because we’d trigger capital gains?

Take the emotional agitation and direct it to a helpful action. This often involves reframing the context from “this is a threat” to “this is an opportunity.”

The extreme sutemi-waza

Sometimes, I even go so far as suggesting actions which are extreme and clearly wrong - it puts the agitated person in the position where they are the voice of reason.

I might say

if you’re sure the market is going down, we should go short the market, ideally on leverage. How much short-leverage should we take out?

I don’t actually want them to do this, but the extremity of it makes them reconsider the strength of their belief, and moderate it.

If this seems risky, it is.

Explicitly wrong, implicitly right

Performing sacrifice throws will feel uncomfortable to many advisors. An integral part of sacrifice throws is that they put you into a potentially disadvantageous position. You might feel like you’re doing the wrong thing now for the right (long-term) reason. You might feel you’re infantilizing your clients by not being direct and properly advisor-ish with them.

Without the context of the client being freaked out, we’d probably not suggest these actions.

It can help to ask if you care about image, or effectiveness. It’s easier and tempting to protect myself by saying, “I said don’t sell, and they did it anyway. Their fault.” It’s cheap to put up signs, but difficult to change actions.

Usually (not always), effectiveness is what matters. The client who insists on selling is unlikely to (and shouldn’t) remain as a long-term client. Yet if I can flip them into doing something less problematic, I have a better chance of helping them as a long-term client.

Sorry, no receipts

In case you’re wondering, I don’t have any peer-reviewed papers or RCTs to support this. This flavor of behavioral design is still an art as much as a science. It’s a way I think about understanding how to help people.

We hate and regret doing nothing: We have a bias for action, even when inaction would be advisable. So we can harness that fear (rather than denying it) use it to give relief.

We’re at our most impulsive when emotionally agitated. I keep an open mind for strategies and tools that work when our emotions are making us stampede, and we can find opportunities to use that momentum for good.