The Business of Emotion

🎶 Feel good, make you feel good, I'm looking for emotion, so I know just want to show you baby 🎶

My personal views only, not those of my employer, government, family, or dog. The title is meant to be ironic.

🎶 Feel good, make you feel good, I'm looking for emotion, so I know just want to show you baby 🎶

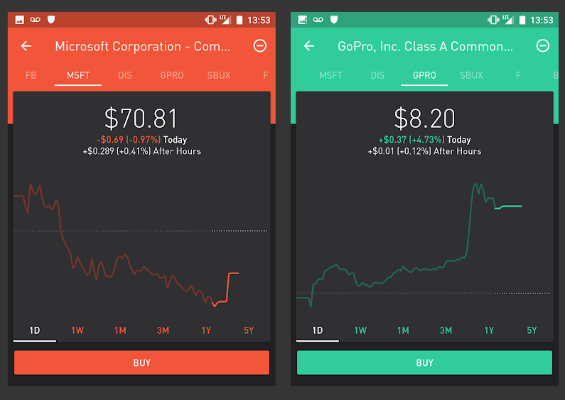

How brokerage app designs show they don't care about success, only activity.

Using technology to be virtuous, effortlessly.

In most areas of life putting in more effort means achieving a better outcome. The harder and more consistently you exercise, the fitter you get. The more hours you put in studying, the better your grades. Of course there are a few, very unusual areas where the opposite rule holds. Aldous Huxley’s called this “The Law of Reversed Effort”: the harder you try, the worse you do. Think of quicksand and finger-cuffs, where success is defined by gentle, slow movements.

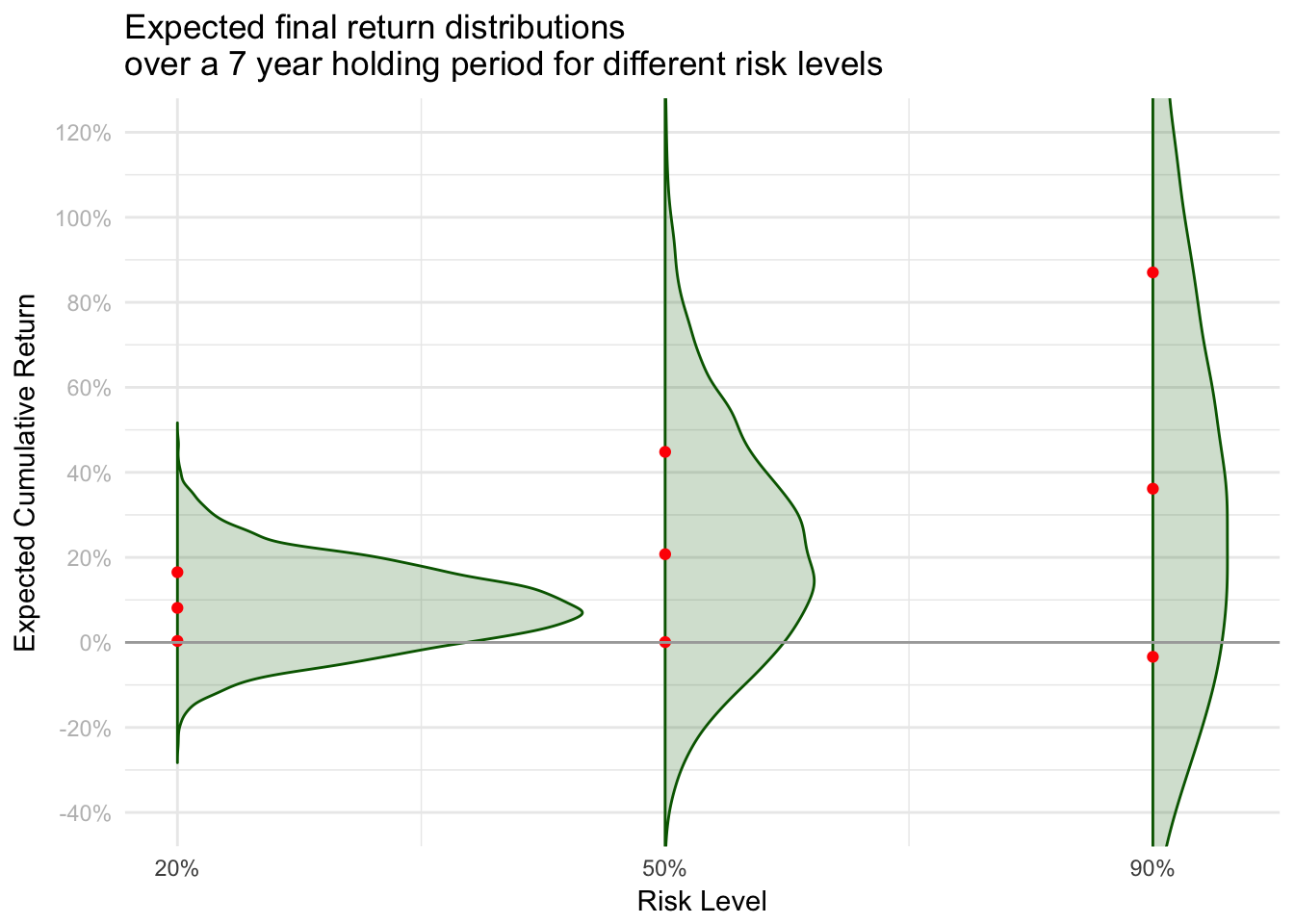

Investors usually understand returns. But risk… risk is more difficult. Risk involves communicating not just that many outcomes are possible, but how likely they are. So I’m in favor of anything that gives investors a better intuition of what risk really is. Andy Rachleff’s post on how the standard efficient frontier graph often misleads investors resonated with me. Investors do often have the perception that the highest return portfolio is best, ignoring the risk.

Do you believe that behavioral biases exhibited by investors can be explicitly addressed through portfolio design?

A curated reading list by what you're looking to get out of it.

Would we recognize intelligence as such if a completely unintuitive architecture or process is performing it?

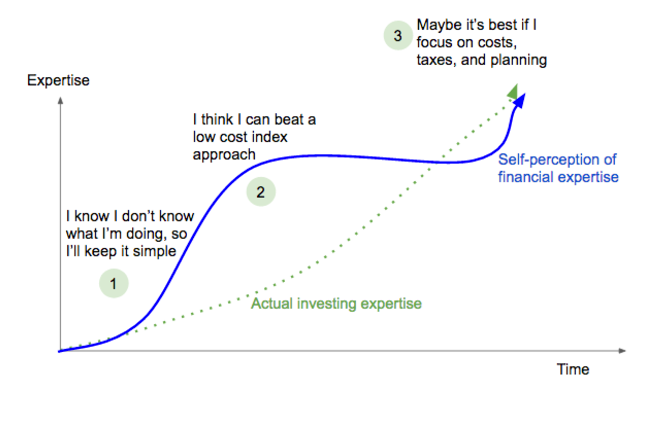

We all have to climb Mount Stupid.

Planning for individual goals can be very powerful in setting you up for success, but it's good to ocassionally step back and check if the big picture still makes sense.