Incentives and behavioral design: brokerage UI edition

January 6, 2018

One of the most powerful behavioral tools is… incentives. And how commercial incentives influence behavioral design deserves some more attention.

Let’s quickly compare the incentives of brokers versus fiduciary advisors.

Brokers generally make money when customers trade, either through commission (e.g. $7/trade) or routing trades to a liquidity provider who pays the broker for those trades. Brokers lend out client cash balances, and do standard banking lending. And they get paid by fund companies to prioritize the fund companies funds, either by making them more salient, or allowing them to be traded for free (these are generally called ‘platforming fees’).

Fiduciary advisors are paid directly from the client for their advice and ongoing management. Many use an assets under management based structure like fund companies do, though there is a movement towards flat fees or annual retainers. There should be no conflicts of interest like commissions or kickbacks from fund providers. The more happy, wealthy clients an advisor has, the more money they make.

Now, I want you to imagine you’re a behavioral designer working at either a broker, or a fiduciary RIA. You are still part of of a commercial profit-seeking business, so you’re expected to contribute to the bottom line, either directly or indirectly.

What impact do incentives have on your work?

Let’s use recent research on giving brokerage customers personalized feedback about their activity and success: over 18 months clients were given monthly feedback on how well they had traded considering costs, risk taken, and diversification. Customers who received the performance reports traded less, diversified more, earned higher returns, and became more successful investors over time.

Now imagine the conversation between the behavioral designer and their boss in a brokerage:

Damian Designer: Hi boss, we have the results of the personalized performance report!

Bob Boss: Great, what was the outcome?

Damian Designer: It was incredible! Customers who received the reports held more diversified portfolios, traded less, and had better performance.

Bob Boss: Uhm, traded less? So if we gave this to everyone, we’d decrease our revenue?

Damian Designer: Well, yeah…

Bob Boss: Great work. Please shred the report and let’s not talk about this again. And please focus on getting people to trade more, not less.

Now imagine if you worked for a fiduciary advisor: it’s a win-win. Clients grow their money fast, and you’re providing a valuable service to help them do so.

The crux is that brokers incentives aren’t well aligned. Clients want to grow their money and be smart. Brokers want them to trade and hold cash. The design you’ll see at a DIY brokerage has been designed, either by commission or omission, to maximize trading and cash holding.

If, theoretically, I worked for a brokerage, how would I design things to maximize trading and cash holding?

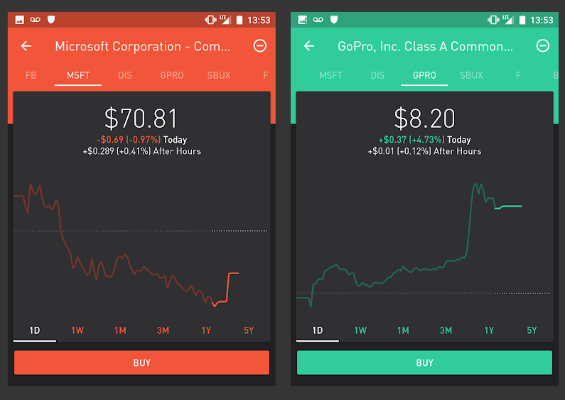

✔ I’d use color to make gains and losses very emotional: green for gains, and bright blood-red for losses. → more trading

✔ I’d default clients performance view to as short a time period as possible, ideally daily, to maximize myopic loss aversion. → more trading

✔ I’d emphasize individual positions, to maximize narrow framing. Diversification means there will likely always be something underperforming, and I want to focus them on that. → more trading

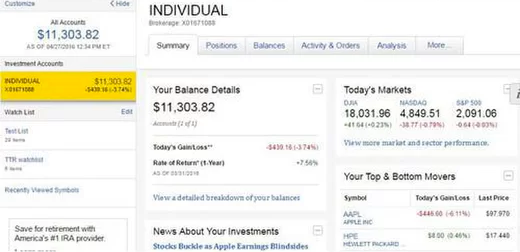

✔ I’d put up biggest gainers & losers to focus them on volatility and opportunity → more trading

✔ I would would not make a dividend reinvestment program the default. → more cash

✔ I’d make cash look safe and reassuring, and not proactively push them to invest it. → more cash

✔ I’d definitely not mention inflation. → more cash

Here’s a screenshot from the web of the logged-in homepage of one of the biggest brokerages. See how many items you can find.

The one element I haven’t see is this: the disposition effect tells us that clients will hold onto losers longer than winners. That means less trading. So I’d want to give clients a positive emotional reason to trade out of losers.

Tax loss harvesting works in taxable accounts, but not tax advantage accounts, so it’s not universally useful.

I hope you can see why I’m very cynical about all the ‘free trades’ brokerages out there today. Much like a casino offers free drinks and perk for big rollers, a ‘free’ brokerage isn’t arranged that way because it’s a charitable organization. These brokerages have just figured out other, less direct ways of charging you, and still making money. Minimizing your trading costs at the expense of maximizing your money’s growth is just silly.

To be fair, these designs also reflect what brokerage clients like to see, and what it’s easy for brokerages to build. People who want to trade like detailed returns information. The page is full of ‘historical facts’ which are easy to produce, but very little ‘future insight’ which is expensive. It’s the convergence of broker incentives and client motivations which create this design.

Alway consider the incentives of your financial counter-party. Know how they get paid, and what that means about how they’ll optimize their service to you.

If you aren’t paying, you aren’t the customer. You’re the product. And generally a company spends time optimizing how to serve its customers, not it’s suppliers.