Change the portfolio, or the investor?

August 23, 2017

This post is a response to Corey Hoffstein’s question: “Do you believe that behavioral biases exhibited by investors can be explicitly addressed through portfolio design?”

No investor is born perfect.

The first step is admitting it, which isn’t easy.

The second step is figuring out what you’re going to do about it.

We need to be thoughtful about how we arrange our decision making. We should protect ourselves from our weaknesses, and leverage our strengths. When performing this personal optimization there is generally a compromise or balance between:

Changing ourselves or Changing the portfolio we invested in

By Andre Mouton

By Andre Mouton

To be clear, when I say changing the portfolio I’m going to restrict that to meaning altering the returns. Why this restriction? Imagine an investor who had no understanding of what or why they were invested in, but they can see their account value. If the portfolio generated consistent positive returns in both absolute and real terms, it’s possible the investor would be well behaved. Good luck finding that investment and having it be real though.

In the realistic case where the underlying has periods of negative performance (relative or absolute), we’ll explore which prevention or coping mechanisms might work, including a realistic modified return profile.

I believe the opportunity to overcome investor biases by altering the return stream is limited…

But… restructuring the portfolio construction process and how we communicate performance_can_ help significantly. Changing the actual portfolio may be a side-effect of a good alignment process.

The true answer lies between the extremes above.

The article below is long, so I’ll summarize the main points:

Changing the portfolio is the easiest option. It’s more concrete and (if we’re honest) sexier to both advisors and clients.

- We all like doing clever, complicated things, and it’s feels better to try to change what’s outside us, rather than inside us.

- There are a few pure portfolio changes that may help, such as drawdown alignment, voluntary blinding to volatility, lock-in structures, and faux-dividends.

Making the portfolio construction process more structured, collaborative and highly personal would be even better.

- Always have a design process which starts with the big questions and works down to the little ones.

- The investor should feel the portfolio is an outcome of their decisions. The more they understand what’s in the portfolio and why, the more they’ll stick with it for the right reasons.

- The more the process focuses on non-return factors, the more effective it will be. Thoughtful performance reporting can help too

- this has the most effective payback

- It’s also is the hardest for most advisors or investors to customize.

Changing the investor

- can take a while for new knowledge and habits to become ingrained.

- it’s a constant process that requires diligent work by investor (and advisor).

- it may require unpleasant learning experiences along the way.

- set up high-fidelity tight feedback loops.

If you want the details, let’s dive in.

1. Changing ‘the portfolio’

There are a few ways in which changing the return profile may address behavioral issues.

But be warned: many of these tweaks can be behavior bias traps themselves, and it’s very hard to modify returns.

Drawdown tolerance

If a client can’t stick with a portfolio through a drawdown, or worries about it even during an upswing, perhaps it isn’t the right portfolio for them. Both in prospect and retrospect, the ideal is that an investor is be comfortable staying the course given how much they might lose. Aligning the portfolio’s expected drawdown with the investors expectations and comfort level is one area where returns may reduce behavioral biases.

There are very simple, effective ways to control risk: diversify and choose an allocation with a total expected drawdown less than what you can handle. Sure, these methods aren’t sexy, but they do work as advertised.

Then there are more complicated methods like systematic tactical strategies and options overlays. While they are transparent to experts, to most investors they are effectively opaque magic.

They may not work as desired during a ‘trial’ phase. They don’t give the investor a feeling of security and control.

As a result, it’s unlikely the client will have faith in the strategy. And that means they will probably revert to watching realized returns, pulling out any time it ‘doesn’t work’. This may be true even if it’s performing exactly as expected (paying the insurance fee), but in a way that is painful to watch.

Aligning risk levels isn’t a panacea of course. Investors want high returns and low risk (don’t we all?) When risky assets are performing well, investors will be tempted to increase risk to match the returns they hear on the news and from friends. During drawdowns they’ll want to end the pain and uncertainty. So alignment might help reduce surprises, it won’t scratch the itch of trying to outperform.

Avoiding mark-to-market assets

No one wants to lose money, even temporarily. Reference points adjust upwards quicker than they adjust downwards. So investments which can appear to have not have downward price volatility can make a customer more comfortable.

A good example of this is holding a portfolio of individual bonds to maturity. By holding a bond to maturity the investor can believe the current price is irrelevant. This allows them to mentally mark the capital as stable, and not see any interim volatility. It’s a form of intentional blinding in which the investor doesn’t automatically see the market value of their portfolio.

⚠️ If they tried to sell the bond the price would reflect any changes in interest rates and credit quality. They haven’t actually avoided interim volatility, they’re just making sure they don’t see it. Read more here.

A recent paper by Andrew Lo et al makes this point with unusual data on hedge funds. One of the benefits of using a hedge fund is simply how they less frequently report returns, and have discretion to ‘smooth’ those returns over time. This produces lower performance chasing behavior by investors, relative to the same investments on a transparent, more frequently reported platform.

Please note that this is just an investment means to a perceptual end: changing performance reporting. One could, in theory, smooth and sporadically report performance with liquid frequently priced assets. Unfortunately, chosing voluntary blindness implies that the investor has significant self awareness to opt-into. Non-mark-to-market assets are a way of doing that through investments - fooling yourself with stale prices.

Converting price return to ‘income’ return

The disposition effect is the tendency of investors to sell stocks which have performed well, but continue to hold stocks which have performed poorly. Closing out a trade (a “mental account”) in a gain feels much better than closing it out in a loss. So during rising markets, investors sell stocks which have gone up because they can close that ‘account’ in a gain, even if they go on to buy other similar stocks.

Investors likewise love getting paid cash dividends and coupons. A dividend is a mental account that has ‘closed out’ as a gain, but without the investor doing anything. It feels like getting a paycheck. And investments distribute income intermittently, which is the most powerful reinforcement schedule.

To be positive about it, dividends may make the skittish investor more comfortable investing- they get positive reinforcement which let’s them feel like they have ‘banked’ profit along the way.

If an investor is particularly prone to the disposition effect, they may prefer and behave better with assets that give them frequent, positive gains in the form of ‘income’ even if this is just capital gains being distributed. Just an idea.

⚠️ This ignores that if you get a dividend from a fund, and promptly reinvest it back in the fund, you can only be worse off than if the fund hadn’t distributed the dividend (due to taxes, time out of the market and bid-ask spreads). But that may be a small price to pay for less anxiety.

Lock-ups

Finally, there are various forms of lock-ups. These are structures where the investor simply cannot convert the investment to cash, or where they’d incur a penalty to do so. Examples are Certificate of Deposit or hedge funds or even stricter private equity funds where a 10 year lock-up is standard. Note that these are different from commitment contracts, where the underlying is liquid, but the investor separately agrees to create impediments or consequences if they try to sell. The issue with many of these lock-ups is that they only stop you from selling in moderately unpleasant scenarios. In a very bad scenario, the investor can get out of them by selling a dramatic discount to the asset value. You can almost always find a buyer, if you discount the price enough. As a result, in the extreme scenarios lock-ups may actually increase the costs of behavioral issues, not prevent them.

2. Portfolio construction process

When we construct furniture ourselves, we value it higher than if someone else put it together. When we’re allowed to tweak or alter an algorithm, we trust it more and believe it’s more likely to be correct. I believe that the more the investor is involved and responsible for the portfolio construction process, and the less it’s about absolute or market-relative returns, the more portfolio design will reduce behavioral issues.

Predefined structure and process

The strength of the American political system is all checks and balances built into it. An entire governing structure set up to prevent myopic, impulsive or oppressive actions. Before you think about investing, write your investing constitution. How will you make decisions? What are the biggest risks to your life and happiness? What frequency will you re-evaluate things over? Where might you make the biggest mistakes? On what basis will you change? How will you know you were wrong or right? Nail down the big decisions before focusing on details. Define the process, then follow it devoutly.

In general, the less it’s about returns, the better.

The more that the construction process is focused on something other than beating a benchmark (pre-tax, time weighted), the easier it will be to reduce impulsive behavior. Any short-term under-performance in a performance-seeking process indicates perhaps the process was wrong. It’s the one factual, first-hand piece of feedback the investor gets! So the more that the purpose of the construction process is something different to top line returns, the better. A diversified set of purposes gives a broader set of performance figures to look at, reducing the chance of one-dimensional thinking.

Focus on goals

Why are you investing and deferring spending? It might be simply to maintain a future standard of living (“retirement”). Or saving for college for a kid (or two). Earmarking funds (including future savings and growth) helps you see the big picture of what you can and can’t afford. It also helps improve your behavior, decreasing the chance you’ll market time and withdraw money impulsively. Don’t find purpose in money. Find money for your purposes.

Focus on expressive dimensions

We have many reasons for investing, and the emotional ones might not directly link to returns in a simple manner. Consider an SRI/ESG tilted portfolio. If the purpose is to generate higher returns, I believe the tilt is unlikely to produce better behavior. But if the purpose is to make the client prouder of their portfolio and feel that it’s tailored for them, I do think it will make them behave better. The more that you can show this in performance reporting, the better (more on that later) You can also create a “play portfolio” to confine the effects of speculative trading to a specific “profit and loss center”. Sometimes harm reduction is more effective than prohibition. Either way, portfolio construction should nudge investors towards considering and aligning their portfolio with all their values.

Focus on why it’s right for each individual

It’s far too easy to lose by [beating the wrong benchmark](https://www.dpegan.com/blog/how-to-lose-by-beating-the-wrong-benchmark/, comparing ourselves to indexes or others. A good portfolio construction process is heavily focused on personalization - on finding tax, or planning, or expressive goals to achieve for that individual. The more that performance is assessed based on a personal benchmark which includes saving and planning, the better. The benefit is that performance will be assessed in a way that doesn’t lead to market timing as a valid solution.

3. Changing Performance Reporting

I believe that you can address many behavioral biases by making investors see their performance differently. When viewed as goals, or as a future version of themselves, or means to non-financial ends, personalized performance can be positive and powerful. Performance reporting should directly align with portfolio construction and future outcomes.

Performance compared to liabilities

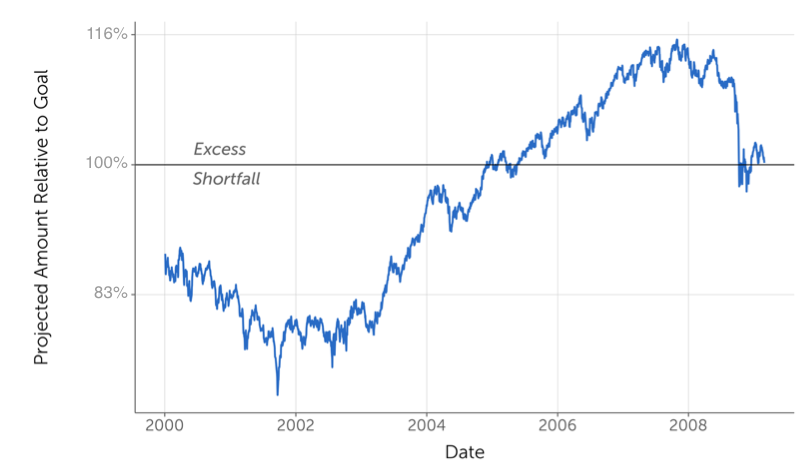

For example, consider reporting on the future-fundedness of a goal. If an investor has a goal they are saving and investing towards, the progress over time towards this goal is far more relevant and stable than market moves. A goal-focused portfolio does need to be actively managed over time. The graph below is one of my favorite for looking at ‘how am I doing’ when related to a $150,000 goal over time. It shows how I’m doing relative to my target balance over time. It’s personal benchmarking for Future-Dan.

Non-financial performance

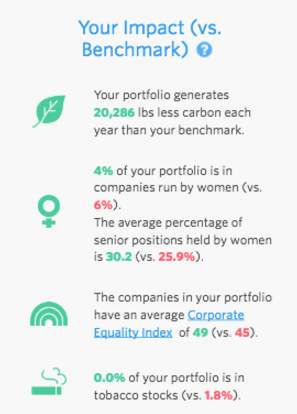

People sometimes forget that the purpose of money is to be spent. Investors are whole human beings, and may ‘spend’ their money by foregoing certain returns, or dedicating their capital to endeavors that resonate with them. But much as they track the performance of their portfolio, they should track the performance of their ‘spending’. This picture is from a socially responsible investing platform which tracks the non-financial performance of your portfolio. As you can see, it makes clear the progress and outcomes from focusing on some non-financial goals of the portfolio. This makes it easier to focus on what your money is doing for you, not just how much it’s grown.

Make it easy to focus on the right things.

If you can, don’t highlight or focus performance reporting on individual component performance. If encourages narrow framing and performance chasing, as clients will react to the winners and losers. You (hopefully) built a diversified portfolio so that some things would bounce while others dipped.

Pro-actively supply a reasonable default benchmark for comparisons. Not providing a good default means we’ll find one lazily, which may be worse (see Yahoo finance example). People want to understand the context of things, and it’s better to provide a high quality context benchmark than create it haphazardly.

Finally, focus performance relentlessly on things you can control: taxes, costs etc. Most performance reporting spends the majority of its real estate on the noise of price changes, not the signal of tax or cost management. By tracking and focusing on the most predictable and controllable drivers of success, we can nudge investors towards putting effort into changing those elements.

4. Changing the investor

Finally, we can think about changing the investor. This is a lifetime journey of learning, experiencing, and training for scenarios that might never happen.

It can take a while for new knowledge and habits to become ingrained.

It’s a constant process that requires diligent work by the investor (and advisor, if there is one).

It may require unpleasant, ego-destroying learning experiences along the way.

It means setting up high-fidelity tight feedback loops to learn as quickly as possible.

This is such a big topic, that it’s going to be it’s own article.