Low cost is better than free

When you zoom out, free goods and services may cost us way more than expected.

My personal views only, not those of my employer, government, family, or dog. The title is meant to be ironic.

When you zoom out, free goods and services may cost us way more than expected.

How to create a false stereotype through sample bias.

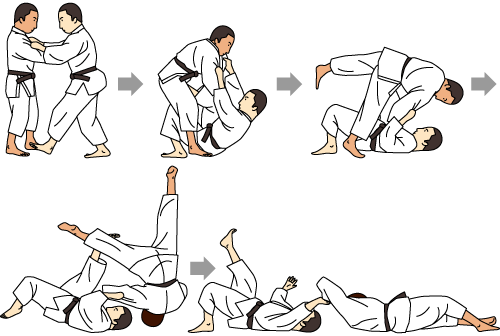

Sutemi-waza are a class of throws in jujitsu or aikido known as sacrifice throws. They are tricky, but very powerful: they work because of the opponent’s momentum.

There’s a game potential clients and advisors play, and I think everyone loses.

There’s a seduction in behavioral science: 'here’s a bias, go be better by not being biased'.